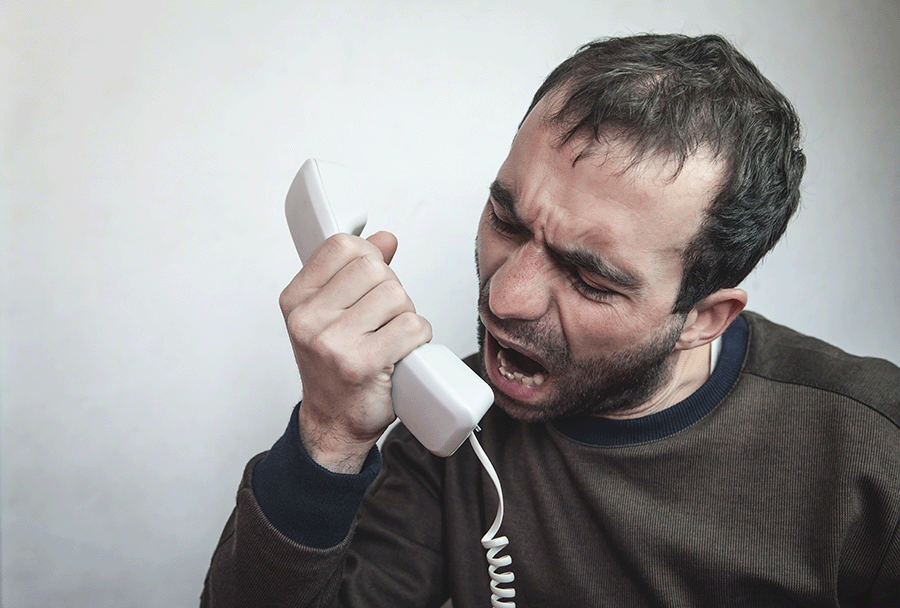

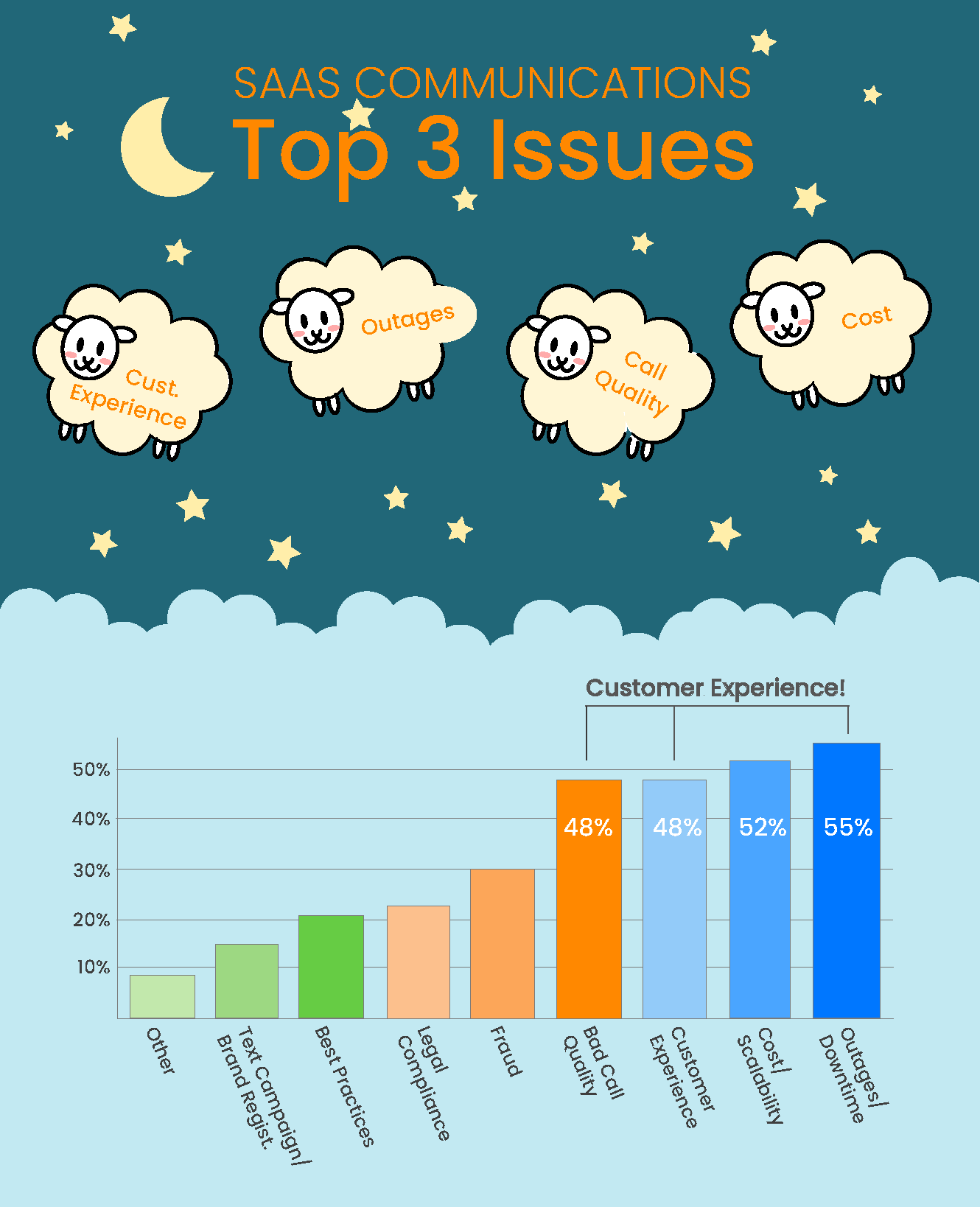

When asked explicitly about the top three communication challenges they face, respondents were clear: customer experience, customer experience, and customer experience. Three of the four highest responses were outages/downtime (55%); bad call quality (48%); and customer experience explicitly (48%). This ranks even higher here than what they said they’re looking for in a provider.

What didn’t align as well? Their high (52%) concerns over cost, even though it occupied just 28% of the top three vendor criteria. This could be because they’re unaware of pricing elasticity and scalability. Or, they prioritize customer experience and assume that “you get what you pay for”—which isn’t always the case. (With intelligent call routing technology, for example, you get the best quality for the lowest price.)

What didn’t align as well? Their high (52%) concerns over cost, even though it occupied just 28% of the top three vendor criteria. This could be because they’re unaware of pricing elasticity and scalability. Or, they prioritize customer experience and assume that “you get what you pay for”—which isn’t always the case. (With intelligent call routing technology, for example, you get the best quality for the lowest price.)

Is Their Support Supportive?

Certainly call quality and uptime are vital; an hour of outage can cost a call center tens of thousands of dollars. To gauge their issues, we started by looking at their support ticket experiences. Although the largest group (28%) said they had filed just 1-5 tickets in the last year, almost the same number (27%) said they had filed over 20. (Surprisingly, 19% said they don’t know.) Only 4% of tickets were resolved within an hour. And while 28% were resolved within four hours, 27% took a full day—and more than 10% took 2-3+ days! At the cost of even an hour of downtime, then, one can understand their concerns.

We also examined the processes they have to mitigate issues. Specifically, 60% have multiple carriers in place (redundancy). This could also mean multiple providers, as some utilize just one or two carriers while others like Commio have more than 40 available. Fifty-percent of respondents also use automated failover; additionally, 38% say they have real-time support from their provider or carrier. However, 12% said they don’t know and another 12% said they have no mitigation plan—virtually a fourth of all respondents.

The Tradeoffs Around Voice

Next we looked at their biggest complaints about voice and how they say their voice providers are performing. A little over half (58%) responded to the open-ended question about voice issues and there were a number of one-off end user issues such as lack of technical proficiency. The single-most common answer was cost/scalability at 19%, however, the combination of customer experience-related issues (e.g., quality, reliability, outages) was once again highest at 33%.

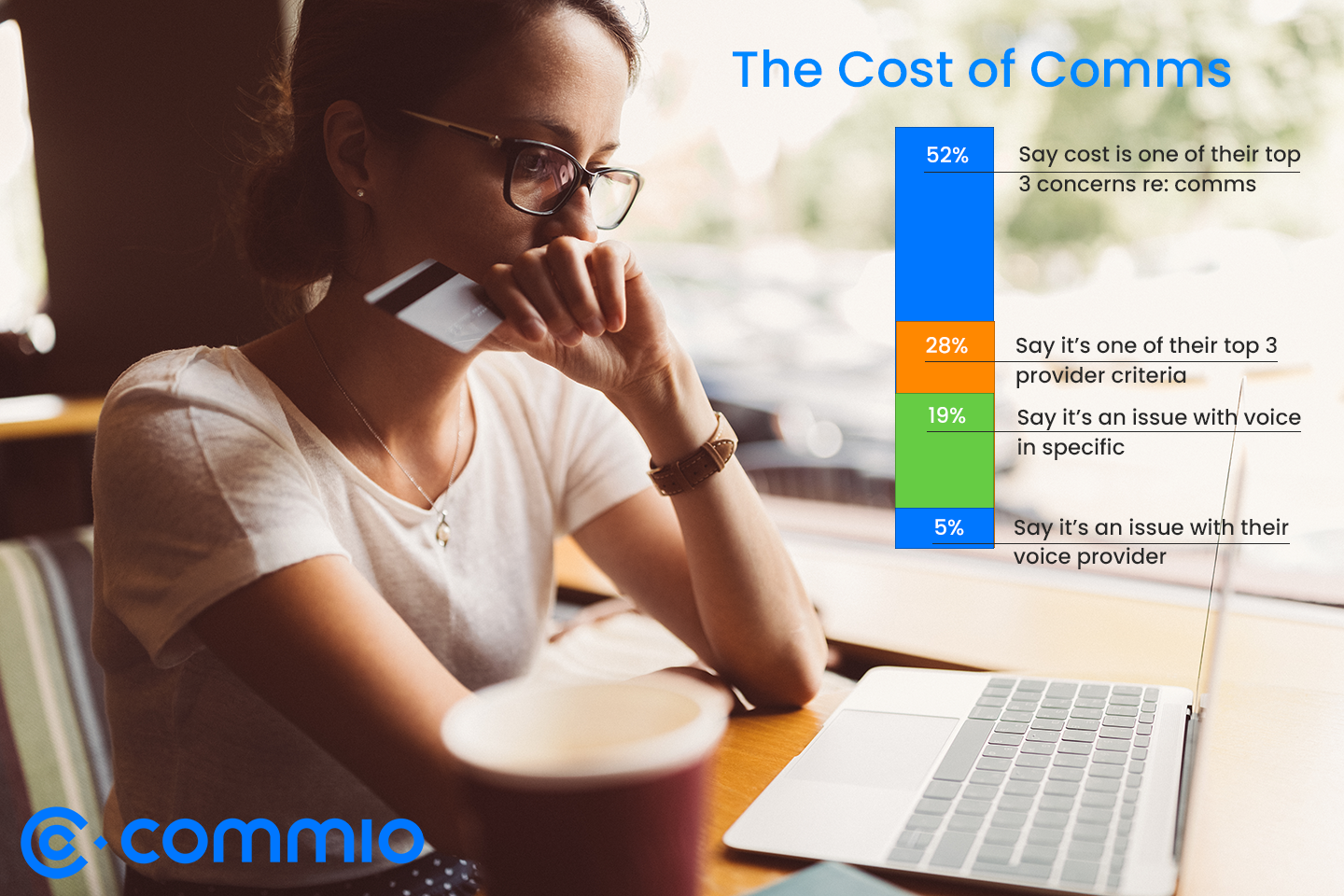

What we found particularly interesting was how the issues they say top their list of concerns, compare to their specific issues around voice, what they look for in a vendor, and issues they have with their specific voice vendor—around cost in particular:

What we found particularly interesting was how the issues they say top their list of concerns, compare to their specific issues around voice, what they look for in a vendor, and issues they have with their specific voice vendor—around cost in particular:

- 52% said it is in their top three concerns around communications

- It is 28% of the top three vendor criteria

- Only 19% list it as a voice issue

- And still less—just 5%—blame their voice provider

The issues around customer experience vary similarly:

-

- Three of the top four biggest concerns were around customer experience, with 48%-55% of respondents citing each of them

- Virtually 100% listed it as one of their top three vendor criteria

- 33% also said it is an issue around voice

- Less than 21% say it’s related to their voice provider

In fact, more respondents explicitly said they have no issue with their vendor, than those who listed either cost or customer experience! We find this data frankly astounding. Respondents say it’s a criteria for choosing a provider, but they don’t seem to hold them accountable. Are they placing the majority of the blame on carriers and absolving their providers? Do they believe that providers have little or no control over these aspects? Or do they find cost and customer experience to be a trade-off?

How Their Messaging Providers are Performing

Although texting is generally less expensive than calling and has less issues around deliverability, we were curious as to whether we’d find similar trends as voice. We applied some of the same questions to see how issues compare and messaging providers seem to be performing.

Virtually a fourth of respondents who use SMS/MMS said they have no issues with the medium. Another 22% cited cost/scalability as their biggest concern. Deliverability came in third at just 16%, followed by 8% with problems around the new long code/10DLC campaign requirements.

An impressive 42% of SMS/MMS users say they have no issues with their messaging vendor. Only 10% hold their provider accountable for cost, while another 8% said they’d like better integration/APIs. Just 2% said deliverability!

* * * * *

Overall, cost and customer experience are the biggest communication issues for small- to mid-size SaaS companies—particularly for voice but also SMS/MMS. They say they prioritize these issues when selecting a provider, but don’t always seem to hold those vendors accountable.

While carriers have more control over these concerns than providers do, companies should seek a provider who actively works to optimize both cost and communication quality. Additionally, they should ensure that they have mitigation plans in place and their providers offer strong real-time support or even some direct customer control.

Part 1: Enhancing Customer Experiences with Cloud Communications

Part 2: Maintaining Relationships During a Pandemic

Part 3: It’s a New Day – STIR/SHAKEN and 10DLC Messaging Rules

Part 4: The Ideal Cloud Communications Provider

Part 5: What Keeps The SaaS C-Suite Up at Night

Part 6: How SaaS Companies Change as They Grow

Download the Cloud Communications Survey White Paper for full results

See the Survey Webinar Video